Voter concerns about inflation are on the rise as people feel the pinch in their household budgets. Since early 2021, people have been feeling the pressure from price increases, especially in gas prices and food costs. Recent White House attempts to blame corporations for rising costs have fallen flat. From our November 22-24 survey for Winning the Issues, by almost 3:1, voters believe the reason prices are going up is because of increased costs due to the supply chain, paying workers higher wages and inflation (64%) rather than corporations expanding profits (23%). In our newest January survey (January 2-4, 1000 registered voters), there is also skepticism about recent White House claims that Americans now have more money in their pockets than before the pandemic which is not believed by 2:1 (25-56 believe-do not believe). Independents do not believe it by an even wider margin (16-61).

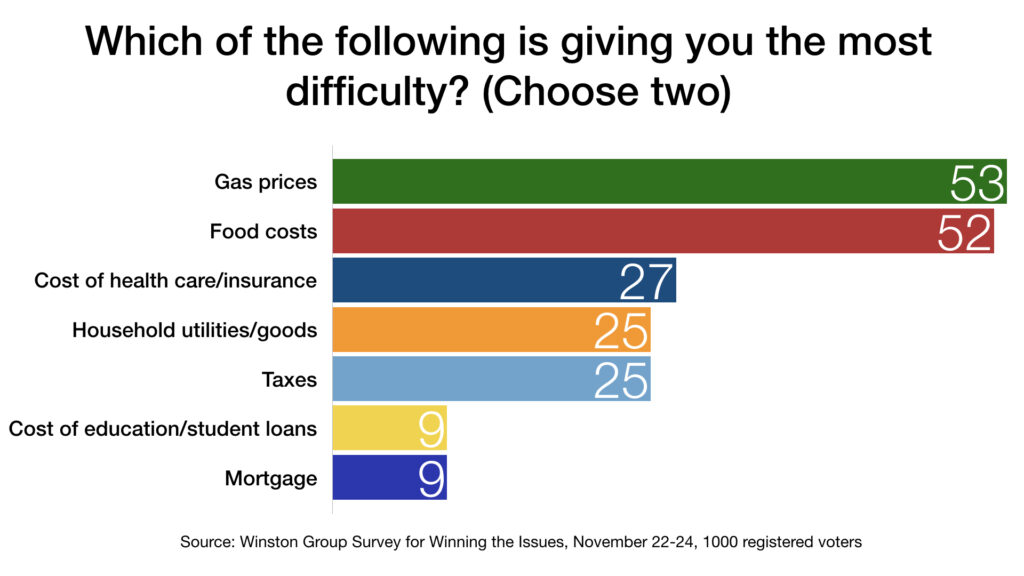

One of the more recent trends around inflation is that gas prices and food costs have now eclipsed the cost of health care and insurance as the expenses giving people the most difficulty in their household budgets. In our November survey, we asked people about the top two items giving them the most difficulty in their households budgets, with gas prices (53%) and food costs (52%) topping the list, with the cost of health care and insurance (27%), utilities (25%) and taxes (25%) being important but secondary factors. This does not mean that health insurance isn’t a major cost concern, but for the first time we are seeing in our research, other expenses are taking the spotlight, most likely because of the frequency of purchasing on a weekly rather than monthly basis.

Stay tuned for more news on inflation which will be a defining issue in 2022.

Special thanks to Myra Miller, Senior Vice President of The Winston Group, for this contribution to The Blog.